How It Works

Instant Title Cash Canada is rapidly emerging as a resource for Canadian’s to solve their financial needs. We provide immediate cash-in-hand service, and all you need is a vehicle free and clear in car cash loans. We are proud to serve multiple provinces with not only the lowest interest rates in the car loan industry but with an alternative debt consolidation resource. Our sales representatives are more than loan officers, they are able to assist you in financial planning by advising you on the loan using your car as collateral & how car loans work.

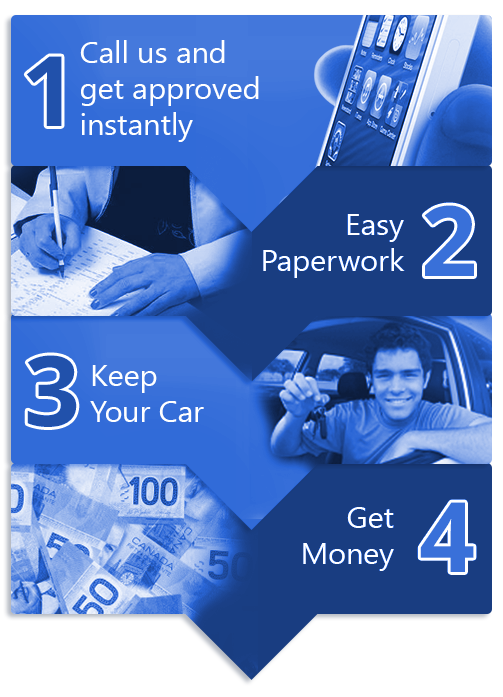

Applying For Instant Car Title Cash Loans in Canada

1. Call Us Or Apply Online & Get Approved

ICC has been a professional lending organization since 2004 providing financing solutions to Canadians nationally. Seamlessly get your car loan by following our simple application process, communicate with our sales representatives and book an appointment. When you leave our office, you leave with cold, hard cash.

2. Easy Paperwork

Our interest rates are significantly lower than that of credit cards and payday loans. You get to save money on interest utilizing Instant Cash Canada and simplify the loan process by avoiding loans from a banking institution. It is a win-win, if you require a loan there is no better solution to your financial situation than a flexible term loan, where you utilize a fully owned asset to get cash and keep your car!

3. Keep Your Car And Drive Off With Cash

Once the car title loan is issued to you, you can keep your vehicle and drive off with cash. Your vehicle is your credit. Don’t let a loan process slow down your lifestyle.

4. Obtain Cash

The amount we loan is determined by the wholesale value of your car. Among the factors that we consider are the year, make, model, mileage and condition of the vehicle. Fill out the online instant auto title cash loan application now!

What You Need:

- Vehicle (vehicle must be paid off and in your name)

- Driver’s License (name must match the name on car name)

- The Vehicle (it must be inspected prior to receiving your loan)

Extra Information On How Car Title Loans Work:

Loan Fees:

The fees associated with lending are all wrapped into a minimum monthly payment. Every payment you make goes towards, interest, fees and the principal. You will NOT be merely paying off interest every month – this ensures that you complete your loan and minimize the debt each and every month.

The fees include the cost of borrowing, gps installation, lien searches, and carproof report fees. For a clearer picture of what you qualify for and the coinciding payments please contact our sales team at Instant Cash Canada!

Loan Source & Renewal Policy:

When you are nearing the end of your loan, or at any point during your loan you require additional funds just call our sales team and find out if your vehicle in conjunction with your client history would allow us to increase the dollar amount of your loan!

Implication Of Late Payment Or Non Payment

In the rare event of a delay or partial payment, please be aware that there may be some interest fees applied to the outstanding amount. Our aim is to make things as smooth as possible for you, and if you’ve been in touch with us, we’ll have a record of your expected payment date – a date that we’ve mutually agreed upon to help you cover any remaining balance.

We believe in open communication and working together to find the best solutions. It’s important to keep in mind that, at times, circumstances may lead to situations like these. Our priority is your satisfaction and financial well-being.

We’re here to help you every step of the way, and our team is always available to answer any questions or concerns you may have. Your peace of mind is our top priority.